Introduction:

As the new year dawns upon us, many of us find ourselves reflecting on the past and contemplating resolutions for the future. One popular and impactful way to kickstart the year is by embracing a “No Spend January” on non-essential items. This challenge not only helps you save money but also encourages mindful spending habits. In this blog post, let’s explore how to successfully navigate a No Spend January, staying motivated, and setting positive financial intentions for the year ahead.

The Rules of No Spend January:

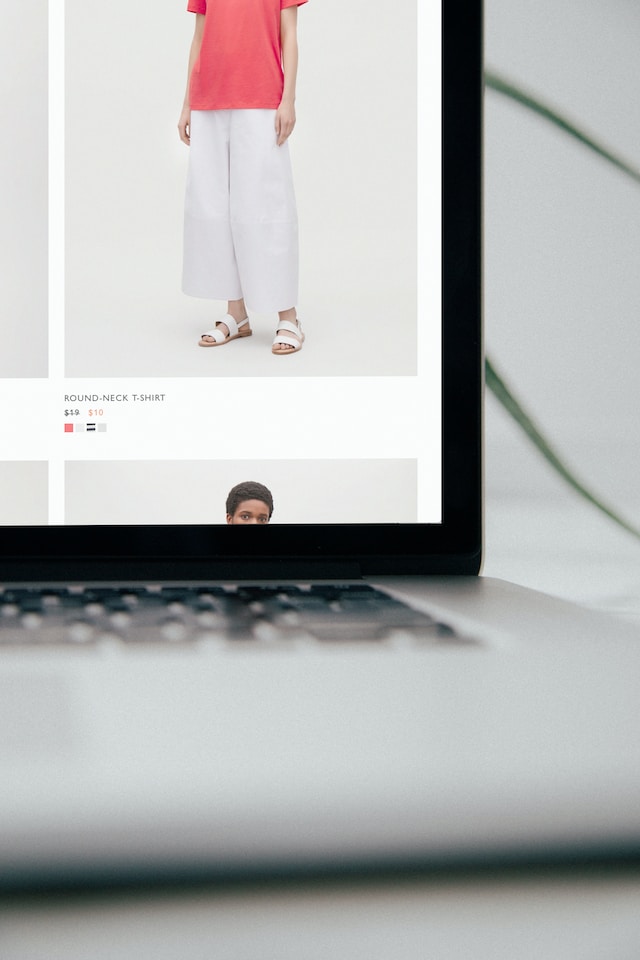

- Identify Non-Essentials: Begin by distinguishing between essential and non-essential expenses. Non-essentials can include fashion items, cosmetics, dining out, and other discretionary spending – for example, for me I will not be buying takeaway coffees and instead will bring my own wherever I go! I will also continue to do my own nails.

- Set Clear Goals: Define your financial goals for the month. Whether it’s paying off debt, building an emergency fund, or simply saving for a specific purchase, having clear objectives will keep you motivated.

Staying Motivated:

- Create a Visual Reminder: Design a visual representation of your financial goals. This could be a vision board or a simple chart tracking your progress. Place it somewhere visible to serve as a daily reminder.

- Find an Accountability Partner: Share your No Spend January goals with a friend or family member who can offer support and encouragement. Having someone to hold you accountable can make the challenge more enjoyable.

- Reflect Regularly: Take time to reflect on your progress throughout the month. Celebrate small victories and learn from any challenges you encounter. This self-awareness will help you stay on track.

Alternative Activities:

I’m planning to use the time I would normally spend shopping on reading more and working out. I’ve always wanted to give yoga a go, so now I have a whole month to focus on it! These thing will be far more rewarding than the instant gratification and short term buzz of buying a new top!

- Explore Free Hobbies: Use your newfound free time to explore hobbies that don’t require spending money. Whether it’s hiking, reading, or learning a new skill online, there are plenty of cost-free activities to enjoy.

- Host Potluck Dinners: Instead of dining out, invite friends over for a potluck dinner. Not only is this a budget-friendly alternative, but it also fosters a sense of community.

- DIY Beauty Treatments: Rather than splurging on cosmetics or spa treatments, create DIY beauty treatments at home. There are numerous recipes online using natural ingredients found in your kitchen.

Setting Financial Intentions for 2024:

- Budget Mindfully: Reflect on your spending habits from the previous year and identify areas where you can make improvements. Create a realistic budget that aligns with your financial goals for 2024.

- Emergency Fund Priority: Make building or replenishing your emergency fund a top priority. Having a financial safety net can provide peace of mind and protect you from unexpected expenses.

- Invest in Learning: Allocate a portion of your budget for personal and financial education. Investing in yourself can lead to increased financial literacy and better decision-making in the long run.

Conclusion:

Embarking on a No Spend January is a powerful way to reset your financial mindset and set positive intentions for the year ahead. By identifying non-essential expenses, staying motivated, engaging in alternative activities, and setting financial goals, you’ll not only save money but also develop healthy financial habits that can last a lifetime. As you navigate this challenge, remember that small, intentional changes can lead to significant long-term benefits. Here’s to a financially fruitful 2024! Are you on board with this idea? Share any tips for success!

© Copyright 2023 Antonia, All rights Reserved. Written For: Tidylife

Leave a Reply